Maslow and Your Mission

So, have you written down your mission? If so, the next step is to figure out your initial approach. However, we first need to have a quick conversation about Maslow and money so that you ensure you both consider a wide enough range of approaches and can sustain yourself on your mission. That’s right, we're talking about budgeting.

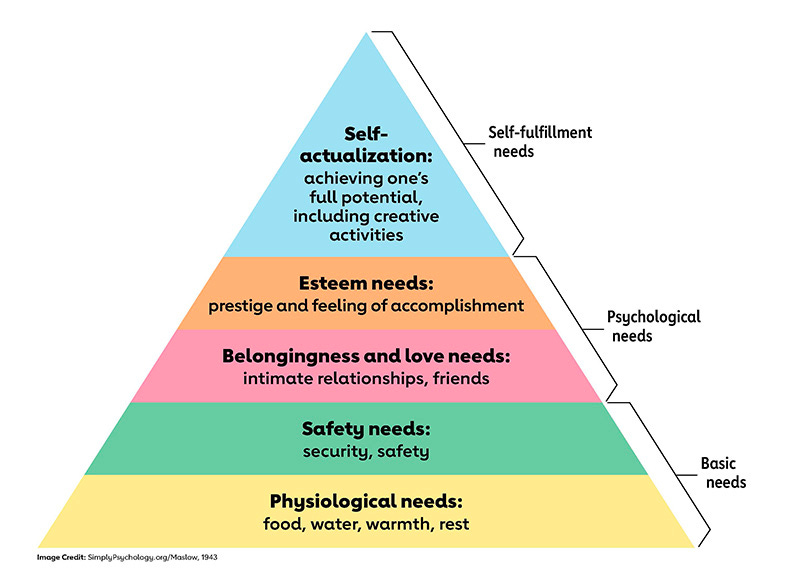

Abraham Maslow is known for his hierarchy of human needs, with basic physical needs taking priority at the base and psychological needs and ultimately self-fulfillment coming once those are met. If you are spending time contemplating the concept of your “mission,” then your Basic Needs are likely met and you are probably in the Psychological Needs level of the hierarchy. You may feel dissatisfied with your current contribution to the world or your current growth trajectory. You may be bored, restless and desiring something bigger and different. Excellent! However, you must ensure your basic needs continue to be met or you will be forced to abandon the pursuit of your mission. To that end, we need to make your financial situation visible.

Despite all of the rhetoric about one’s risk tolerance, the amount of risk you can tolerate on your mission is best quantified by how many months of living expenses you’ve saved up, even if it is variable. Everything else is usually an emotional response to the fact that you don’t know the answer. Until you understand this, you are likely to consider a very narrow set of approaches (usually jobs) that conflate your need to both eat and achieve your mission.

The math here is straightforward, but can be tedious. You need to understand how much you spend each month (remember to include annual expenses!), how much money you actually have, and calculate how many months you could survive at your current standard of living if you have no money coming in, if that ends up being your path. YNAB (You Need A Budget) is very helpful in this and I cannot recommend them enough. I would dedicate 3-5 hours to answering this question, and then 20 minutes a week. Personally I look at my financial picture for about 5 minutes every day to stay current.

So what did you find out? Maybe it is 6 months, maybe you are in debt and have negative 5 months. Please stop and do the work to figure this out, regardless of your phase of life or even of the answer, because clarity and peace of mind will make the road ahead much easier.

Once you understand your situation, you can recast your basic needs as the problem statement requiring a certain amount of money every month, to which a job is a wonderful (plus benefits!) but not the only solution. This level of specificity is required before you begin to consider approaches, so that you can take a broad enough view to find approaches to your mission that are likely to succeed, while sustaining you on your mission.

With that out of the way, let’s talk about how you can approach your mission.